Middle East Stock Markets Decline Amid Oil Price Drop and US Tariff Announcements

Market turmoil affects Gulf economies as investors react to rising tariffs and falling oil prices.

Stock markets across the Middle East experienced significant declines on Monday, influenced by new U.S. tariffs and a sharp decrease in oil prices, leading to heightened investor anxiety throughout the region.

The downturn has raised alarms regarding the implications for energy-dependent Gulf economies, posing challenges to government budgets and ongoing economic diversification initiatives.

The Dubai Financial Market (DFM) opened with a steep drop of six percent, while the Abu Dhabi Securities Exchange (ADX) fell four percent during the morning session, although both indices managed to reduce their losses by the close of trading.

The DFM ended the day down 3.08 percent, while the ADX declined by 2.59 percent.

In contrast, Saudi Arabia's Tadawul All Share Index saw a positive day, gaining 1.05 percent to close at 11,194.02, attributed to unwavering investor confidence in the Kingdom.

This rise occurred against a backdrop of broader market pressures, as optimism within the Saudi market stood out among its regional counterparts, which all closed negatively.

Trading on the Saudi exchange was marked by significant activity, with a turnover of SR10.5 billion ($2.8 billion), and 150 stocks experiencing gains against 91 that declined.

Negative trends were observed in other regional markets, with Bahrain falling by 1.15 percent, Qatar by 0.35 percent, Muscat by 0.68 percent, and Kuwait by 0.64 percent.

Among the stocks on the Saudi exchange, the National Co. for Learning and Education reported the highest growth for the day, with an increase of 8.84 percent.

In the DFM, major real estate entity Emaar Properties experienced a drop of nine percent early in the day, alongside Emaar Development and Dubai Islamic Bank, both of which incurred losses exceeding eight percent within the first quarter-hour of trading.

The ADX suffered similar setbacks, with leading companies such as Adnoc Gas down by 4.9 percent, First Abu Dhabi Bank falling by 2.83 percent, and Multiply Group decreasing by 6.17 percent.

Market analysts have indicated that rising tariffs are dampening trade optimism while the decline in oil prices is significantly affecting Gulf Cooperation Council (GCC) economies.

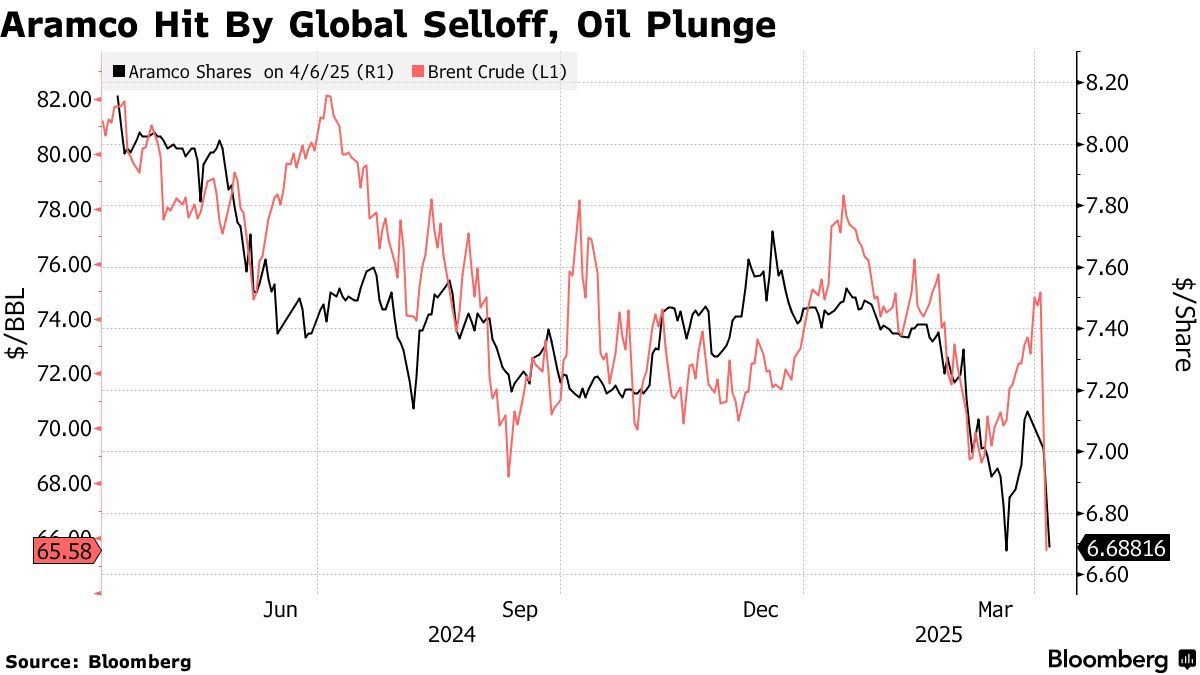

Oil prices have decreased markedly, with benchmark Brent crude prices falling nearly 15 percent over the past five days to settle just above $63 per barrel.

This figure represents a 30 percent decline from the $90 mark of the previous year and remains below the break-even price for several GCC countries, intensifying fiscal challenges.

The overall sentiment in the markets has been overshadowed by fears of economic repercussions stemming from tariff announcements made on April 2, which have led to a ten percent decline in the Tadawul since then.

Market segments heavily impacted include capital goods, which have dropped 15 percent, and insurance and pharmaceuticals, which are down 14 percent.

Even traditionally resilient sectors like real estate investment trusts (REITs) and telecommunications have experienced mid-single-digit losses.

The decline in stock values has also been reflected in the performance of Saudi Aramco, whose shares fell over five percent on Sunday, contributing to a significant reduction in market capitalization.

Analysts are expressing concerns over the impact of the latest U.S. tariffs, which have introduced a potential for increased inflation that might negatively affect disposable incomes and consumer spending.

The tariffs of 10 percent are applicable to GCC states, including the UAE, Saudi Arabia, Bahrain, Kuwait, Oman, and Qatar, while Iraq faces tariffs of 39 percent and Syria 41 percent.

The new tariffs, coupled with the potential for retaliatory measures, could disrupt global trade conditions.

Concurrently, OPEC+ has decided to accelerate oil output increases, marking the first rise in production levels since 2022. This shift towards monthly targets for higher output is anticipated to inject further volatility into oil markets already grappling with tariff-related consequences.

Despite current market turbulence, the Middle East regions have shown resilience since April 2022, following an IPO surge that attracted numerous new investors.

Foreign inflows into GCC equities have remained robust, with recent figures showing an increase from $939 million in January to $2.47 billion in February.

As the Middle East navigates this period of uncertainty, investors are diligently watching for signs of stabilization, amid ongoing market fluctuations.

The downturn has raised alarms regarding the implications for energy-dependent Gulf economies, posing challenges to government budgets and ongoing economic diversification initiatives.

The Dubai Financial Market (DFM) opened with a steep drop of six percent, while the Abu Dhabi Securities Exchange (ADX) fell four percent during the morning session, although both indices managed to reduce their losses by the close of trading.

The DFM ended the day down 3.08 percent, while the ADX declined by 2.59 percent.

In contrast, Saudi Arabia's Tadawul All Share Index saw a positive day, gaining 1.05 percent to close at 11,194.02, attributed to unwavering investor confidence in the Kingdom.

This rise occurred against a backdrop of broader market pressures, as optimism within the Saudi market stood out among its regional counterparts, which all closed negatively.

Trading on the Saudi exchange was marked by significant activity, with a turnover of SR10.5 billion ($2.8 billion), and 150 stocks experiencing gains against 91 that declined.

Negative trends were observed in other regional markets, with Bahrain falling by 1.15 percent, Qatar by 0.35 percent, Muscat by 0.68 percent, and Kuwait by 0.64 percent.

Among the stocks on the Saudi exchange, the National Co. for Learning and Education reported the highest growth for the day, with an increase of 8.84 percent.

In the DFM, major real estate entity Emaar Properties experienced a drop of nine percent early in the day, alongside Emaar Development and Dubai Islamic Bank, both of which incurred losses exceeding eight percent within the first quarter-hour of trading.

The ADX suffered similar setbacks, with leading companies such as Adnoc Gas down by 4.9 percent, First Abu Dhabi Bank falling by 2.83 percent, and Multiply Group decreasing by 6.17 percent.

Market analysts have indicated that rising tariffs are dampening trade optimism while the decline in oil prices is significantly affecting Gulf Cooperation Council (GCC) economies.

Oil prices have decreased markedly, with benchmark Brent crude prices falling nearly 15 percent over the past five days to settle just above $63 per barrel.

This figure represents a 30 percent decline from the $90 mark of the previous year and remains below the break-even price for several GCC countries, intensifying fiscal challenges.

The overall sentiment in the markets has been overshadowed by fears of economic repercussions stemming from tariff announcements made on April 2, which have led to a ten percent decline in the Tadawul since then.

Market segments heavily impacted include capital goods, which have dropped 15 percent, and insurance and pharmaceuticals, which are down 14 percent.

Even traditionally resilient sectors like real estate investment trusts (REITs) and telecommunications have experienced mid-single-digit losses.

The decline in stock values has also been reflected in the performance of Saudi Aramco, whose shares fell over five percent on Sunday, contributing to a significant reduction in market capitalization.

Analysts are expressing concerns over the impact of the latest U.S. tariffs, which have introduced a potential for increased inflation that might negatively affect disposable incomes and consumer spending.

The tariffs of 10 percent are applicable to GCC states, including the UAE, Saudi Arabia, Bahrain, Kuwait, Oman, and Qatar, while Iraq faces tariffs of 39 percent and Syria 41 percent.

The new tariffs, coupled with the potential for retaliatory measures, could disrupt global trade conditions.

Concurrently, OPEC+ has decided to accelerate oil output increases, marking the first rise in production levels since 2022. This shift towards monthly targets for higher output is anticipated to inject further volatility into oil markets already grappling with tariff-related consequences.

Despite current market turbulence, the Middle East regions have shown resilience since April 2022, following an IPO surge that attracted numerous new investors.

Foreign inflows into GCC equities have remained robust, with recent figures showing an increase from $939 million in January to $2.47 billion in February.

As the Middle East navigates this period of uncertainty, investors are diligently watching for signs of stabilization, amid ongoing market fluctuations.

Translation:

Translated by AI