Trump and Tech Giants: A Landscape of Changing Interests

U.S. Justice Department Takes Action Against Major Tech Firms Amidst Legislative Movements

The intersection of Donald Trump and the technology sector is marked by complex dynamics as the United States Justice Department and the Federal Trade Commission (FTC) prepare to implement significant regulatory measures targeting large technology companies.

Recently, Trump is anticipated to endorse bipartisan legislation aimed at combating the rise of deepfake technology, coinciding with ongoing efforts from the White House to sever technological ties with China.

A critical question arises: Does Trump advocate for technological freedom or does he adopt a populist stance against tech giants?

Trump's position appears intricately linked to his immediate personal interests.

This was exemplified when Amazon's 'Amazon Basics' division, focused on low-cost products imported directly from Chinese warehouses, considered releasing data illustrating the effects of tariffs on consumer pricing.

In response, a spokesperson for Trump characterized this action as “antagonistic and political.”

The Amazon initiative represented an opportunity to leverage the vast data resources held by major technology firms.

Such data could potentially inform consumers through a system akin to a “nutrition label” for supply chains, detailing the impact of tariffs on prices and the marginal cost increases for major corporations—likely to be minimal.

However, following a conversation between Amazon founder Jeff Bezos and Trump, the matter was quickly dismissed.

This incident highlights the conflicting signals from the Trump administration regarding technology and regulation.

Furthermore, Vice President J.D. Vance maintains a long-standing relationship with technology billionaire Peter Thiel, while also expressing admiration for former FTC Chair Lina Khan and her anti-monopoly campaign.

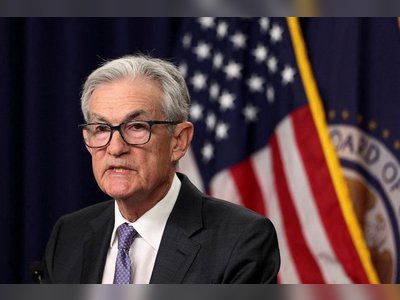

Among impending developments, corrective actions concerning Google’s antitrust practices are expected to be announced in the coming weeks.

Indeed, FTC Chair Gigi Sohn has advocated for stringent measures that include discontinuing the default search engine agreement with Apple, divesting the Chrome browser, and licensing search data to competitors.

Sohn's pro-market stance diverges from Khan’s views, as she challenges the Silicon Valley narrative that posits a need for consolidation in the face of competition from China.

In a recent interview, she remarked, “We believe we should trust our system more and not think that to compete with China, we must become more like them.”

Sohn, reflecting the views of many liberal thinkers, supports regulatory interventions to protect the innovation landscape from the dominance of large tech firms, which often either eliminate emerging startups that threaten their fundamental business models or acquire them.

She cites the breakup of AT&T during the Reagan era, which spurred mobile telecommunications innovation, as a precedent.

Protecting future innovators who may create the next Google or Meta necessitates a profound comprehension of the formidable barriers erected by tech giants around their operations.

This understanding has led the FTC to take legal action against Uber, accusing the company of obstructing users wishing to cancel subscription services—a claim Uber has strongly denied.

This regulatory approach, which addresses information asymmetries and obscured business models, aligns in part with the Biden administration’s strategy.

However, Trump’s methodology stands in stark contrast to his predecessor’s, who recalibrated the concept of 'power' at the center of political economy to evaluate the dominance of large tech firms.

The previous administration's shift away from a conventional 'consumer welfare' standard in digital economic regulation—rooted in information exchange—was viewed as both audacious and effective.

Trump, in contrast, adopts a highly opportunistic view towards 'regulatory power,' evident in his handling of the ‘Buy or Bury’ case against Meta.

Reports indicate that CEO Mark Zuckerberg has made vigorous attempts to lobby Trump personally in hopes of convincing regulators to accept a settlement of $450 million—substantially less than the $30 billion in penalties being sought by authorities.

Despite Zuckerberg’s assumption of securing Trump’s favor, those efforts did not materialize; it is suggested that the last individuals Trump engaged with were FTC representatives rather than those from Meta.

Such circumstances raise questions regarding the likelihood of Trump negotiating deals with Zuckerberg or Google to ease anti-trust enforcement in exchange for personal or political incentives.

In terms of technological decoupling from China, this remains a domain where Trump exhibits firmness, as evidenced by a prohibition on the export of AI chips produced by Nvidia.

However, his expansive imposition of tariffs has prompted the European Union to consider imposing substantial digital taxes aimed at Silicon Valley companies.

Consequently, the reality of the United States simultaneously engaging in battles with both Europe and China is likely to deter other nations from aligning with American technology.

Ironically, these tariffs may inflict greater harm on smaller firms compared to their larger counterparts, further consolidating the strength of the tech giants.

As long as these large corporations appear aligned with Trump, it is unlikely that he will express concern over these implications.

Recently, Trump is anticipated to endorse bipartisan legislation aimed at combating the rise of deepfake technology, coinciding with ongoing efforts from the White House to sever technological ties with China.

A critical question arises: Does Trump advocate for technological freedom or does he adopt a populist stance against tech giants?

Trump's position appears intricately linked to his immediate personal interests.

This was exemplified when Amazon's 'Amazon Basics' division, focused on low-cost products imported directly from Chinese warehouses, considered releasing data illustrating the effects of tariffs on consumer pricing.

In response, a spokesperson for Trump characterized this action as “antagonistic and political.”

The Amazon initiative represented an opportunity to leverage the vast data resources held by major technology firms.

Such data could potentially inform consumers through a system akin to a “nutrition label” for supply chains, detailing the impact of tariffs on prices and the marginal cost increases for major corporations—likely to be minimal.

However, following a conversation between Amazon founder Jeff Bezos and Trump, the matter was quickly dismissed.

This incident highlights the conflicting signals from the Trump administration regarding technology and regulation.

Furthermore, Vice President J.D. Vance maintains a long-standing relationship with technology billionaire Peter Thiel, while also expressing admiration for former FTC Chair Lina Khan and her anti-monopoly campaign.

Among impending developments, corrective actions concerning Google’s antitrust practices are expected to be announced in the coming weeks.

Indeed, FTC Chair Gigi Sohn has advocated for stringent measures that include discontinuing the default search engine agreement with Apple, divesting the Chrome browser, and licensing search data to competitors.

Sohn's pro-market stance diverges from Khan’s views, as she challenges the Silicon Valley narrative that posits a need for consolidation in the face of competition from China.

In a recent interview, she remarked, “We believe we should trust our system more and not think that to compete with China, we must become more like them.”

Sohn, reflecting the views of many liberal thinkers, supports regulatory interventions to protect the innovation landscape from the dominance of large tech firms, which often either eliminate emerging startups that threaten their fundamental business models or acquire them.

She cites the breakup of AT&T during the Reagan era, which spurred mobile telecommunications innovation, as a precedent.

Protecting future innovators who may create the next Google or Meta necessitates a profound comprehension of the formidable barriers erected by tech giants around their operations.

This understanding has led the FTC to take legal action against Uber, accusing the company of obstructing users wishing to cancel subscription services—a claim Uber has strongly denied.

This regulatory approach, which addresses information asymmetries and obscured business models, aligns in part with the Biden administration’s strategy.

However, Trump’s methodology stands in stark contrast to his predecessor’s, who recalibrated the concept of 'power' at the center of political economy to evaluate the dominance of large tech firms.

The previous administration's shift away from a conventional 'consumer welfare' standard in digital economic regulation—rooted in information exchange—was viewed as both audacious and effective.

Trump, in contrast, adopts a highly opportunistic view towards 'regulatory power,' evident in his handling of the ‘Buy or Bury’ case against Meta.

Reports indicate that CEO Mark Zuckerberg has made vigorous attempts to lobby Trump personally in hopes of convincing regulators to accept a settlement of $450 million—substantially less than the $30 billion in penalties being sought by authorities.

Despite Zuckerberg’s assumption of securing Trump’s favor, those efforts did not materialize; it is suggested that the last individuals Trump engaged with were FTC representatives rather than those from Meta.

Such circumstances raise questions regarding the likelihood of Trump negotiating deals with Zuckerberg or Google to ease anti-trust enforcement in exchange for personal or political incentives.

In terms of technological decoupling from China, this remains a domain where Trump exhibits firmness, as evidenced by a prohibition on the export of AI chips produced by Nvidia.

However, his expansive imposition of tariffs has prompted the European Union to consider imposing substantial digital taxes aimed at Silicon Valley companies.

Consequently, the reality of the United States simultaneously engaging in battles with both Europe and China is likely to deter other nations from aligning with American technology.

Ironically, these tariffs may inflict greater harm on smaller firms compared to their larger counterparts, further consolidating the strength of the tech giants.

As long as these large corporations appear aligned with Trump, it is unlikely that he will express concern over these implications.